Learn how to convince the government to support your startup with a grant and how Sepior got 2 million Euro in support from the EU

Governments provide grants to startups based on the assumption there is a market failure with funding for a specific activity and there are externalities, so it’s good for the government to make grants available even though it’s at a cost. They do get something back. The difference is that they believe these activities wouldn’t have happened without the grant. In other words, the key for success to getting public grants comes down to two things:

- The business idea helps the government achieve their goal

- The government is convinced you couldn’t have continued otherwise

The first point is that governments do not give money out to all startups, but only to those that can help the government meet a specific societal or socio-economic goal. In order to get a grant, the startup needs to know what they can help the government achieve. They need to find out what kind of support programmes have been created to achieve specific government goals (for example, improving jobs in certain industries, getting university research grants or advancing clean environment projects). Then comes the very important second point which many startups miss when applying for public grants: the government only gives grants to startups when they believe the startup would not be able to continue otherwise! If that isn’t the case, the money could have been better spent elsewhere, since the goal of the government is not to support your company but to achieve its own goals (by having more startups working on them). In other words, you will have to convince the funding body not only that your startup can help them achieve their goals but also that you cannot proceed without the grant!

So how do you ensure your startup gets the public grant out of the many that apply? You can improve your chances by having the following points in mind:

1. If you’re not a grant application expert, hire one!

To be fair to everyone, the government requires you to fill out plenty of paperwork to apply for grants. You need to include information about what you want to achieve and how you can help them achieve their goals.

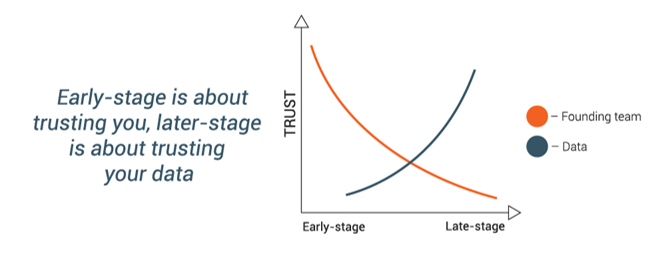

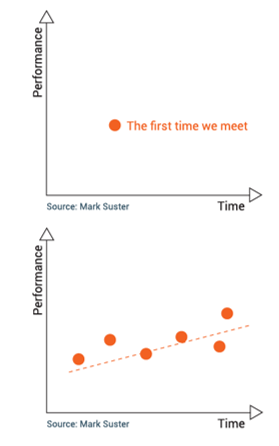

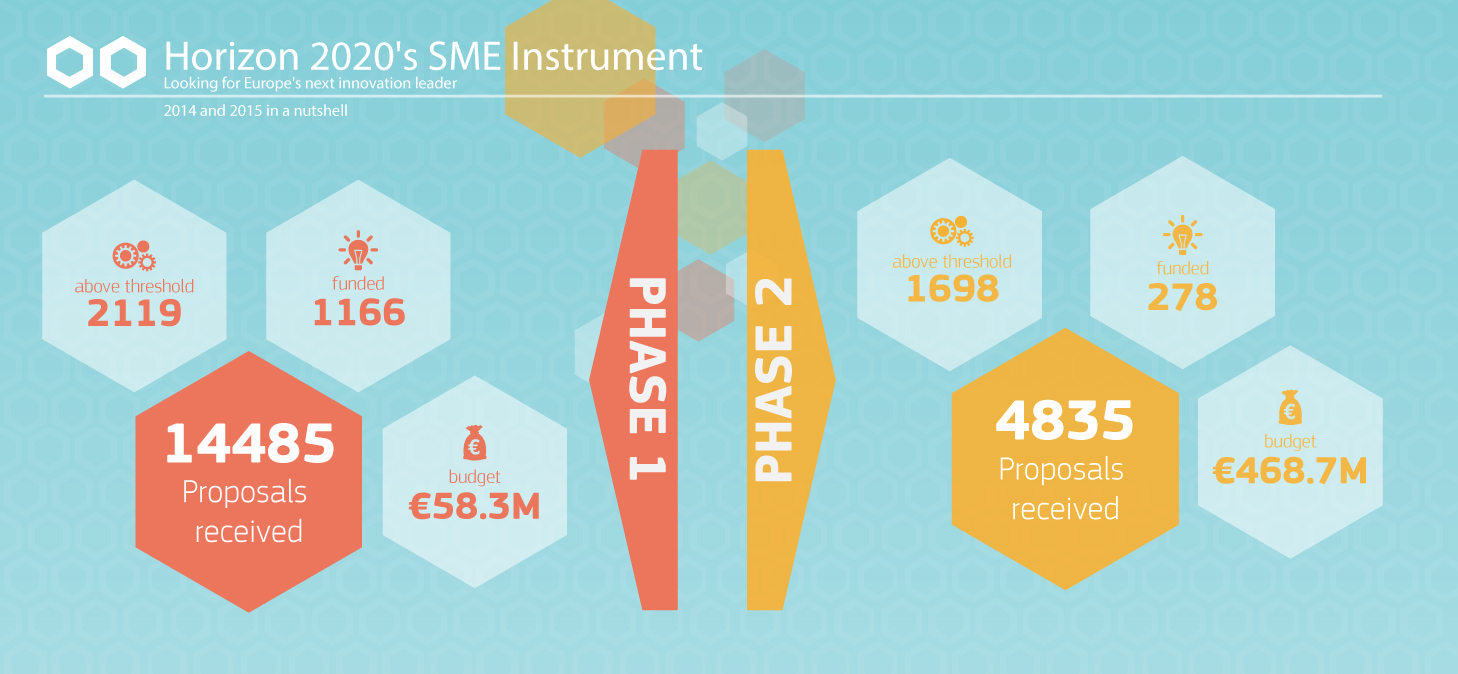

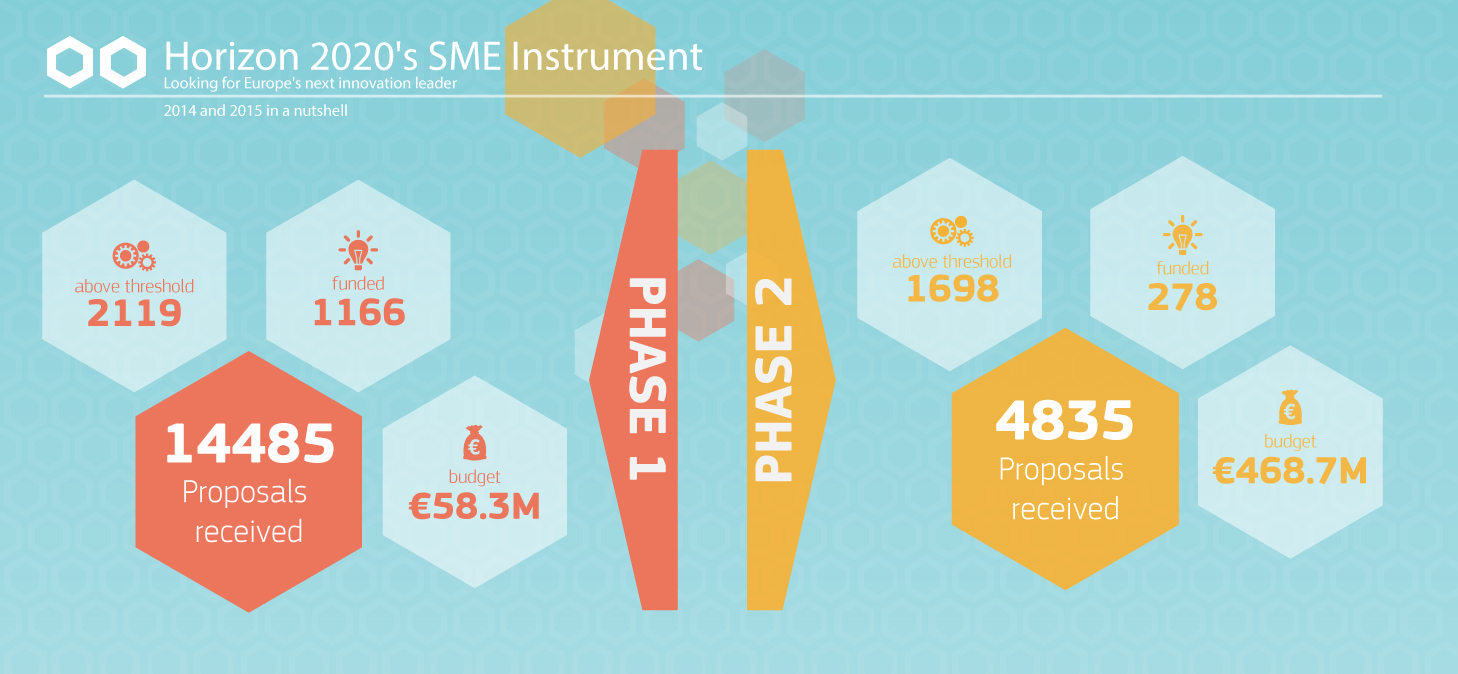

There is of course huge competition for such public grants. The infographic below shows statistics for one of the largest public grants in Europe, the Horizon 2020 SME Instruments managed by the EU, where Phase 1 is the small grants (up to €50,000) and Phase 2 (the large grants of up to €2.5 million). For Phase 1 applications, eight per cent got funding and for Phase 2, fewer than six per cent were successful. They base their decision on the paperwork you submit. This is unlike approaching a VC fund or business angel where the personal relationship is key and you need an introduction. Wining and dining matters much less to get this type of funding; what you write down matters much more. You can get a conventional venture capitalist to invest in your startup if you’re a fantastic

person with charisma and a strong network and you’ve done it all before. But that’s no use if you apply for a public grant and write a poor application. You won’t get the grant even if your idea is great and you have a strong team to back it.

2. You need co-financing!

The time it takes to produce a good quality application, and the bureaucracy involved in evaluating the application, means it normally takes at least three to six months from application to grant. On top of this, most grants are paid as cost-reimbursement. The grant is paid after the cost has been incurred, leading to further need for short-term liquidity even if you get the grant. But you also need co-financing for the grant itself. Normally the grants don’t cover a hundred per cent of the cost. For most public grants, the percentage of cost covered by the grant is between 50 and 75 per cent. In the above-mentioned example, EU SME Instruments, the grant covers up to 70 per cent of the total cost. The startup must then fund the remaining 30 per cent or find other external funding. But if the public really want to achieve its goals, why don’t they pay a hundred per cent of the costs? Saving money is one reason, but another is that they want to ensure incentive on

behalf of the entrepreneur. Imagine if they paid a hundred per cent of the costs for a project. This would lead to a ton of applications from startups just to get their salaries paid. These would most likely be projects with a lower chance of success since the startups’ motivations are flawed. The government is looking to strike a balance with its grants: they want to invest in things that help the public achieve its goals and where there is incentive for doing so, but this can’t be done if the entrepreneur must cover a hundred per cent of the costs. Even with a government grant you need co-financing. It is however much easier to attract private investors (for example business angels) if you can go to them and say 75 per cent of the cost is already covered with a public grant!

Case study: Sepior receives €2 million from EU

Sepior is a Danish cyber security company that was founded in 2013 when it received €500,000 in funding from both a local seed fund and business angels.

In 2015 the initial product (encryption software to protect cloud data from hacking) was finalised and tested by a number of potential customers. Sepior, together with some partners, applied for EU funding of approximately €2,300,000 to be used for further R&D and further market development. The money was provided by the EU support programme SME Instruments Phase 2, which provides public grants up to €2,500,000 to cover up to 70 per cent of project costs. Why was Sepior (of which the author of this blog is co-founder) successful in their grant application?

1. Sepior found a public grant topic that fitted them very well.

The specific SME instrument topic was: “The Open and Disruptive Innovation (ODI) scheme aims to foster the development of fast-growing, innovative SMEs with promising, close-to market ideas bearing high disruptive potential in terms of products, services, models, and markets”. Here was a grant allocation clearly aimed at SMEs like Sepior, who were close to market (the core product was already developed) and had disruptive potential. Sepior had developed a ground-breaking technology that had the potential to disrupt the way we protect cloud data; all in all, a very good fit between grant topic and the project.

2. Sepior had a very strong team with external support:

Sepior is lucky to have a world-class technical team and one of its co-founders is one of the most cited researchers in the world within cryptography. This was a very important part of the successful grant application. In addition, Sepior asked outside opinion leaders in IT security to write letters of support which they included in the application. These letters gave even more credibility to the team.

3. Sepior showed credible co-financing:

When a relatively small startup asks for a €2 million grant, that pays up to 70 per cent of the costs, you don’t need a maths degree to figure out they also need significant co-financing. To improve the credibility of our application, and in order to convince the grant body we could secure such co-financing, we asked both existing and potential investors to demonstrate their interest in co-financing via letters of intent we included in the application. Together with extensive calculations on how we would cover the financing needs, that documentation was essential for us getting a positive review of our application.

4. Sepior spent a lot of time and used external experts:

The team behind Sepior was lucky that some of them had extensive experience in writing other EU grant applications while others had extensive experience in writing business plans and investor material. Compared to the average startup, we had the skills needed to write the application, and we literally spent hundreds of hours on it. The first time we submitted the application it didn’t get over the threshold. This highlights both the tough competition and how hard it is to write an application if you haven’t applied for the specific grant before and don’t know exactly what the evaluators are looking for. After the first attempt, we were close to the goal and decided to ask an outside expert to review our application and propose changes. The input from that expert, and the further hundreds of hours spent on revising the application, were essential for getting the grant the second time we applied.

————

If you are interesting in knowing more about startup funding, then consider participating in one of Nicolaj Højer’s hands-on master classes. Next is to be held in Copehagen on May 3rd: Sign up here.