Dilution – Splitting equity in startups

Many entrepreneurs are chasing investors but the real question any entrepreneur should ask yourself is, do you really want the investors’ money?

Why shouldn’t you? Well, first of all because no investor will be giving you the money for the sake of your blue eyes – except your mum and uncle, of course. The rest want something in return – a share of the company. In startup jargon this is called ‘dilution’, when your share of the company is diluted by investors.

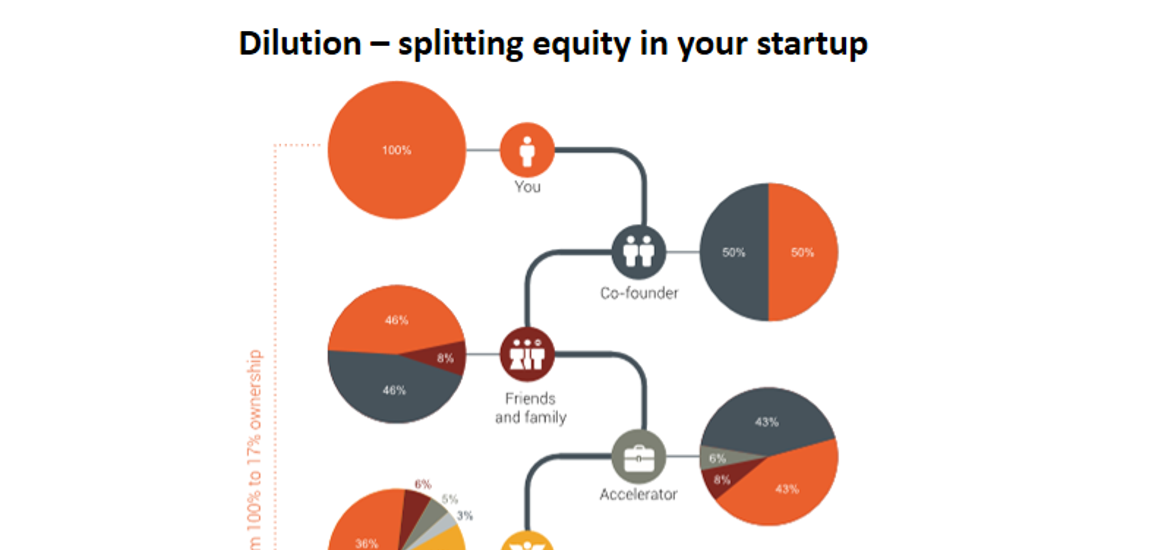

The example below illustrates a typical dilution for a company that receives funding from the usual suspects at the different stages of the company. It starts with you getting a co-founder, and having friends, angels and accelerators invest in the company. Next you give shares to the first employee and later employees in the form of an option pool, and then you receive huge investment from a local venture capital fund and later an international venture capital fund.

So is going from 100% of a very small cake to 17% of (hopefully) a large cake worth it? This depends on your specific situation and what you really want to do with your startup. Is it more important for you to be in control of your company, even if it’s a small one, than to grow it into a world-leading company? Then you certainly shouldn’t go this route! But if you have a startup where you need funding to grow, or grow fast enough, VC and other types of investors might be exactly what you need!

You should ask yourself: Do we really need the money? Will the money really make a tremendous difference for our company – or could we achieve what we want without it? And if we need money, do we need it now or could it wait till later?

It’s hard to find entrepreneurs who regret they didn’t take in external investors earlier in the journey, while it’s easy to find entrepreneurs who regret taking in investors too early when (they know with hindsight) they would have been able to bootstrap longer.